Commentary: How To Make Sense Of The Columbo Economy — “Just One More Thing”

By Nancy Tengler, CEO & Chief Investment Officer

My mentor in this business was a brilliant, if somewhat quirky man. His office was a storage room for unread research and old copies of The Wall Street Journal. When the clutter became overwhelming, he moved out of his office—the only private one on the floor—to a desk in the bullpen. Usually, mine. This clearly seemed easier to him than sorting through the rubble.

Like Columbo, his appearance was an afterthought. Fashion never entered his mind. Everything was investing, 24×7. To the point of boring every client over dinner, hijacking every meeting—a single mindedness delivered in rambling seemingly random speech, wrapped in a forgetful professor demeanor and crowned with a profoundly consistent inability to read social cues. Still, I loved the guy!

When I asked him what he planned to do with the piles of research that caused his nomad status, he replied, “I’ll get to it. I learn so much more from reading things after the fact.”

I think he was on to something.

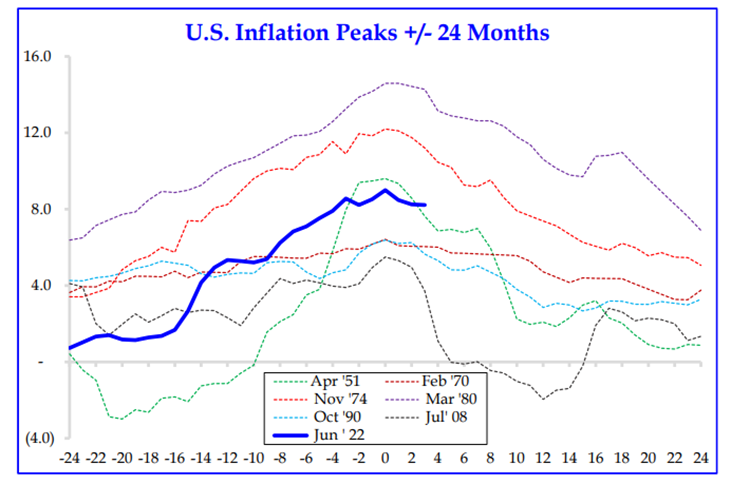

Peak inflation and timing of Fed pause. It was our contention in the spring of 2021 that inflation would be more persistent and stickier than the Fed’s transitory view. We take no comfort in being correct. We have written that we believe peak inflation in the headline CPI was reached in June of this year when it hit 9.1%. And we believe, as history shows, that the rise and fall of inflation is mostly symmetrical. It took 16 months to peak and now we expect it will take a like amount of time to get to a tolerable level (not necessarily 2.0%–the Fed’s target).

It is important to point out that in previous inflationary periods dating back to 1951, one year after the peak in inflation stocks are up 18.2%.

Just one more thing… Fed policy has a 9-month lag and let’s remember that the Fed only began raising rates in March. But we are seeing encouraging signs that inflation is rolling over: inventories on the rise, new orders down, prices paid down, commodities have declined, M2 is almost flat after rocket shot growth in 2020 and 2021, and transport costs are collapsing.

After two weeks of traveling (without a copy of The Wall Street Journal to be found), I was doing some catch up reading of my own and noted this headline from October 3rd: “Cargo Shipowners Cancel Sailings.” Just a year ago, companies like Walmart and Home Depot were chartering their own ships, now they’re canceling orders. And the cargo companies are canceling sailings. Add to that, Nike announced 65% more inventory than this time last year. Markdowns are coming. Great news for goods inflation.

And maybe just a bit more good news. Financial news pundits quote every economic number with a kind of certainty that belies the nuanced way many of the numbers are calculated. Economics is an inexact science at best. Health care’s contribution to September core inflation was recently referred to as a “methodological quirk” accounting for a sharp rise over August. The data represents about a 10-month lag which means the activity actually took place in 2021 when consumers were catching up on healthcare that was put off during COVID. This anomaly will correct itself in coming months but had a significant impact on the higher than anticipated print.

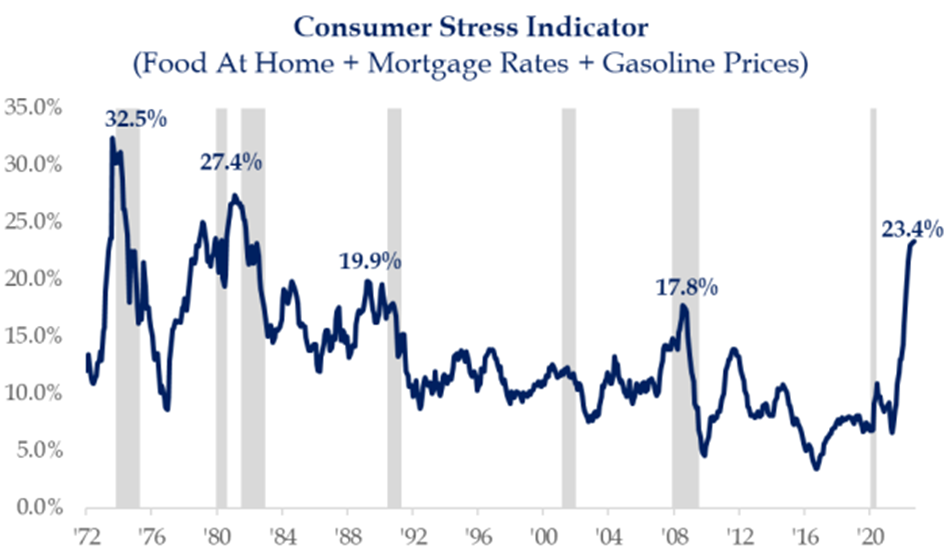

If inflation has peaked and is beginning to roll over then the Fed is likely to pause in early 2023. And not a moment too soon for the average household.

The Fed is in its quiet period, but we have heard recent comments from voting and non-voting members that it may be time to slow policy down some. Additionally, a recent admission from two voting members that the inflation surge came from “supply chains, energy and commodities” not “from the labor market” is encouraging.

Oh, and just one more thing… despite the comments above, Fed Chair Powell remains determined to put a dent in the job market. And we thought we were making progress when the JOLTS number declined last month from over 11MM open jobs down to just over 10MM open jobs. But this morning, the September number was reported at 10.7MM, a full 1MM jobs more than was forecast.

We will be listening very carefully to Fed Chair Powell tomorrow.

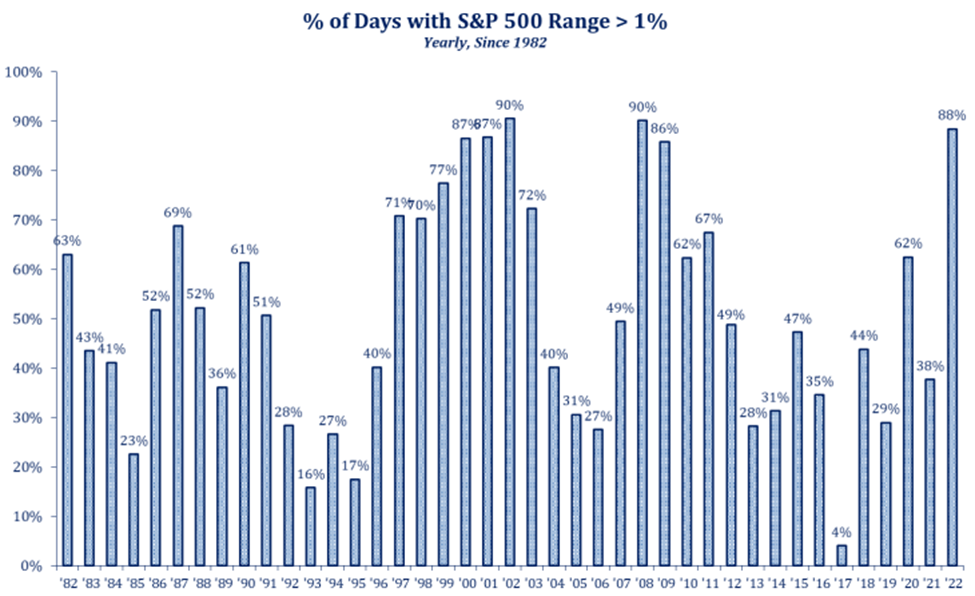

The very last thing… I know I don’t have to point this out, but volatility has been excessive this year. Indeed, it is the most volatile year since 2009. The volatility is unlikely to subside until the market believes the Fed is done. We are mindful of Benjamin Graham’s famous advice, “The investor’s chief problem—and his worst enemy—is likely to be himself. In the end, how your investments behave is much less important than how you behave.” We are constantly looking for opportunities to provide protection through asset allocation, strategy allocation and stock selection.

The Fed: Power and Politics

Many of you have asked if the Fed has become too political. Recent forays into climate change and income inequality by the Fed certainly appear political and do nothing to serve the bank’s “dual mandate” which was established by Congress in 1977 to “promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.1

Strike one, two and three.

Since the dawn of our nation, the central bank has been controversial. The First Bank of the United States was proposed by Alexander Hamilton and approved by President Washington in 1791 with a twenty-year charter. The bank was viewed by the opposing party (led by Thomas Jefferson) as a “corruptive force in the republic.” Despite a poor track record during the War of 1812, President Madison signed an act establishing the second Bank of the United States, also carrying a twenty-year charter.

In his biography “The First Populist, the defiant life of Andrew Jackson, David S. Brown recounts, “the bank further provoked debate by making capital available to select investors in internal improvements.” Jackson saw this as an effort to advance a small aristocracy of cronies. And, although the Supreme Court sided with the Bank in McCulloch v. Maryland affirming the constitutionality of both central banks. Unfortunately, President Jackson disagreed.

Jackson vetoed the recharter bill passed by Congress stating he did not believe the Supreme Court’s ruling bound him. Yikes. Is the Fed political? History shows that since founding, the Fed has been fraught with politics.

The question now is will it continue to be? We think yes. And, if so, in what ways? Of course, that remains to be seen.

1 Federal Reserve Bank of Richmond, December 1977

General Disclosures

Advisory services offered through Laffer Tengler Investments, Inc. Information and commentary provided by Laffer Tengler Investments, Inc. (“Laffer Tengler”) are opinions and should not be construed as facts. The opinions expressed are those of Laffer Tengler’s Investment Team. The opinions referenced are as of the date of the publication and are subject to change due to changes in the market or economic conditions that may not necessarily come to pass. Forward-looking statements cannot be guaranteed. This is not a recommendation to buy or sell a particular security, nor is it financial advice or an offer to sell any product.

The market commentary is for informational purposes only and should not be deemed as a solicitation to invest or increase investments in Laffer Tengler products or the products of Laffer Tengler affiliates. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. There can be no guarantee that any of the described objectives can be achieved. Laffer Tengler Investments, Inc. does not undertake to advise you of any change in its opinions or the information contained in this report. Past performance is not a guarantee of future results. Information provided from third parties was obtained from sources believed to be reliable, but no reservation or warranty is made as to its accuracy or completeness.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable. The price of any investment may rise or fall due to changes in the broad markets or changes in a company’s financial condition and may do so unpredictably. Laffer Tengler Investments, Inc. does not make any representation that any strategy will or is likely to achieve returns similar to those shown in any performance results that may be illustrated in this presentation. Always consult a financial, tax, and/or legal professional regarding your specific situation.

There is no assurance that a portfolio will achieve its investment objective. Past performance is not indicative of future results.

Definitions and Indices

The S&P 500 Index is a stock market index based on the market capitalization of 500 leading companies publicly traded in the U.S. stock market, as determined by Standard & Poor’s.

Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions, or other expenses of investing. Investors cannot make direct investments into any index.

Laffer Tengler Investments, Inc. is a Registered Investment Advisor. Registration with the SEC or a state securities authority does not imply a certain level of skill or training. Laffer Tengler’s advisory fee and risks are fully detailed in Part 2 of its Form ADV, available on request.