Tengler: Asking Investors For Patience is Never A Good Plan

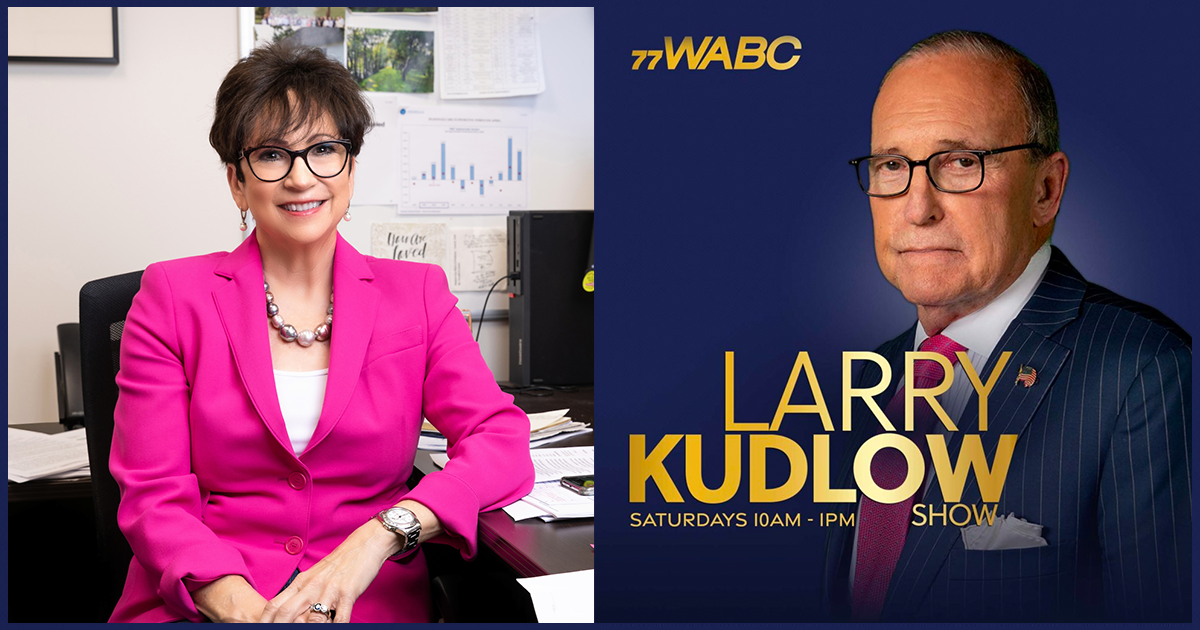

Nancy Tengler, CEO and Chief Investment Officer at Laffer Tengler Investments, explained on a recent episode of Bloomberg Brief why Mark Zuckerberg’s statement about Meta might not effectively reassure current investors or attract new ones.

Read More