Commentary: Beware the Hastings Cutoff

By Nancy Tengler, CEO & Chief Investment Officer

Every school-age child in California studies the desperate and tragic story of the Donner Party. Death, cannibalism, and a risk-taking gambit to take a previously unknown and un-traveled cutoff known as the Hastings Cutoff to ostensibly reach California sooner marks the deadly and disastrous trip.

Donner Pass on Highway 80 is the mountain highest pass to Truckee and the Tahoe Basin where the majority of the Donner Party met their demise. Deadly even now, this modern-day pass carries a message for travelers. With all due respect to Mr. Brown, hope is not a strategy.

Just miles from Donner Pass in Incline Village we are under yet another severe weather warning with risk of avalanches and blizzard conditions that will likely close all the major arteries for the third or fourth time in a matter of weeks. In his book, Desperate Passage: The Donner Party’s Perilous Journey West, Ethan Rarick writes, “On a journey into the unknown, perfect progress is perfectly impossible.” Which brings us to the markets.

After a robust January rally to commence 2023 (and following a volatile and negative 2022), A February winter storm in the stock and bond markets once more tested the mettle of investors. The Bloomberg Intermediate Government/Credit Total Return index logged in a negative 1.80% and all the major equity indices were negative as well for the month. The bears were back in full force explaining to investors all the reasons why they should opt for cash instead. Take the Hastings Cutoff.

And then came March.

Even with February’s decline, the risk-on trade we have been discussing since the fourth quarter has produced decidedly positive returns. Especially so since the market formed what we believe to be a bottom on October 12th. As of Friday, March 3rd all of the equity indices are once again positive for the year with the NASDAQ in the lead. There is still a great deal of conflicting economic data which means we expect continued volatility—as Ethan Rarick reminds, “perfect progress is perfectly impossible.”

Investing requires discipline as we often declare. Short-cuts are rarely successful nor rarely produce sustainable returns.

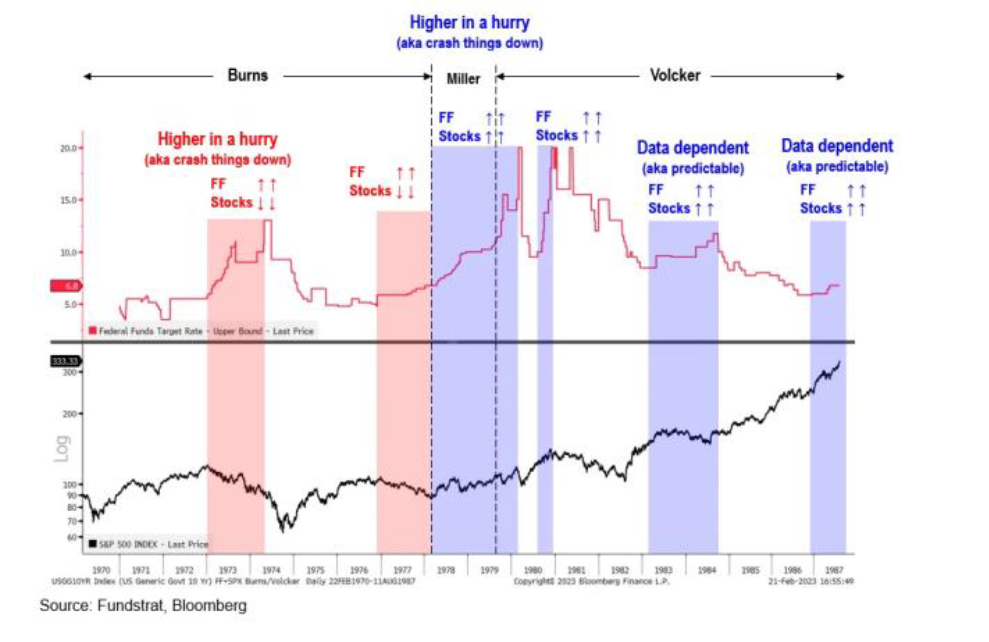

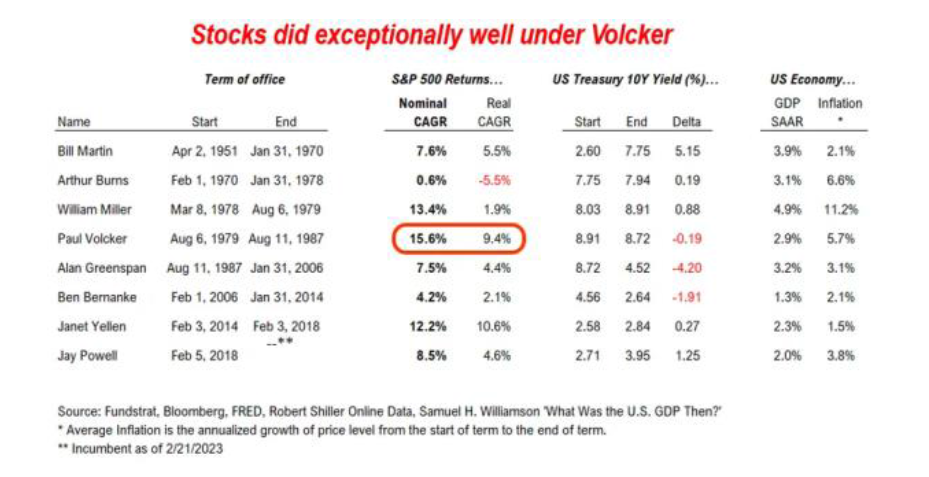

The Volcker Era. Much has been made about the double-dip recession during Fed Chairman Paul Volcker’s tenure and current Chairman Powell’s invokes Volcker in expressing a desire not to repeat his “mistake.” But, the double dip recession does not tell the stock market’s story. We have consistently pointed out that stocks did very well during Volcker’s tenure. The S&P 500 returned 362.3%–the Volcker bull market (August 6, 1979-August 11, 1987).

The real problem for equities was during the Arthur Burns era which preceded Volcker. Burns’ Fed was “data reactive” which is how Powell’s Fed conducted policy beginning in September 2020 through the fall of 2022. By the time Powell took action, just one year ago, inflation’s rapid rise scared the Fed into raising rates quickly (much like Burns) which drove all risk assets and even bonds into a rapid decline. Much has been made of 2022 as the year the 60/40 portfolio failed, or Powell’s Burns Bear Market. But Powell’s Fed has recently indicated they are now “data dependent” focusing on many of the same metrics the market

(and former Chairman Volcker) pays attention to. At the very least, this new focus on data is more predictable. And equities like predictable.

Tom Lee of Fundstrat recently published a piece discussing this very thing, likely more eloquently than we have. According to Lee, the real (after inflation) compound annualized return during Volcker’s tenure was 9.4%. As you can see below, stocks did significantly better under Volcker than during Arthur Burns’ tenure. The table following shows stock returns, the 10-year Treasury yield and GDP growth during various Fed chairmen/women back to 1951, also from Lee’s Fundstrat.

No one knows for sure if we are in the early stages of a new bull market (we think we are), whether the U.S. economy will enter recession (we think it will), whether the recession will be shallow or deep (we think shallow), hard landing or soft landing…well you get the idea. But to position our asset allocation and readjust our equity holdings appropriately we really don’t need to nail the answers to those questions.

Just as we exited bonds in August of 2020 when the yield on the 10-year Treasury hit 0.50% we didn’t know that the Fed would enter a rate hiking regime in March of 2022 and bonds would underperform, we just knew bonds were expensive and were unlikely to continue an almost 40-year bull market. (We have since returned to short duration bonds.) Adding back to risk in our equity portfolios, too, was a function of valuation, dividend growth and the ability to produce reliable earnings growth in, at the very least, what we believe to be a slowing growth environment.

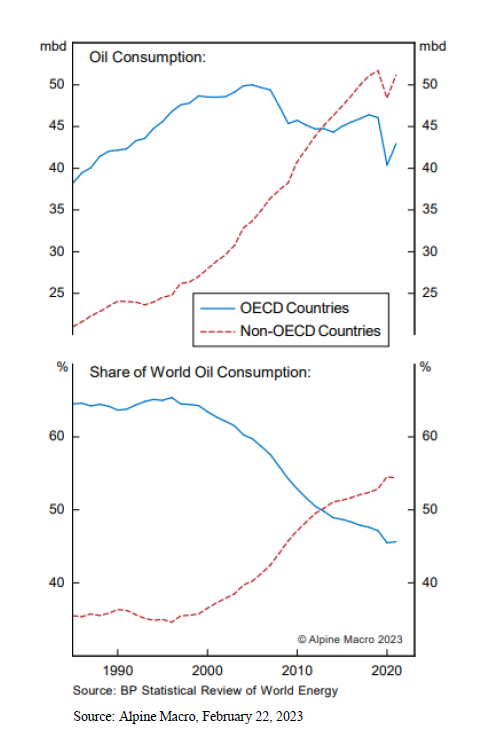

Why we are still bullish on oil. In a recent commentary, we announced a name change for our strategy focused on the metals and miners that drive planetary decarbonization to the Clean Energy Infrastructure strategy. We have hedged that portfolio with exposure to oil and natural gas because we believe the bridge to clean energy will take time.

Additionally, the decline in capital spending in traditional energy companies due to ESG pressures is limiting investment, which limits supply—a significant input to energy prices. Demand for energy is the other input to price. The chart below shows the greater impact on demand from emerging markets than has historically been the case. EM consumption is far less responsive to higher oil prices and emerging markets are far less focused on green energy.

In 1980, developed countries made up 68% of global oil demand, today emerging markets make up 55% of demand according to Goehring and Rozencwaig Associates. It will take much higher prices for crude oil to lure the production of more supply. In the meantime, we remain committed to our Clean Energy Infrastructure strategy and our overweight to energy.

Earnings season is coming to an end. Stocks will be focused on macro issues again in the near term with all eyes on the Fed. Every data point will be examined and reacted to despite the fact that most of those numbers will likely be revised. We will be watching the nonfarm payrolls (March 10th) which came in super-hot in January. Will the numbers be revised down and, if so, by how much. That hot number in early February set stock investors for the exits. We will be watching.

General Disclosures

Advisory services offered through Laffer Tengler Investments, Inc. Information and commentary provided by Laffer Tengler Investments, Inc. (“Laffer Tengler”) are opinions and should not be construed as facts. The market commentary is for informational purposes only and should not be deemed as a solicitation to invest or increase investments in Laffer Tengler products or the products of Laffer Tengler affiliates. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. There can be no guarantee that any of the described objectives can be achieved. Laffer Tengler Investments, Inc. does not undertake to advise you of any change in its opinions or the information contained in this report. Past performance is not a guarantee of future results. Information provided from third parties was obtained from sources believed to be reliable, but no reservation or warranty is made as to its accuracy or completeness.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable. The price of any investment may rise or fall due to changes in the broad markets or changes in a company’s financial condition and may do so unpredictably. Laffer Tengler Investments, Inc. does not make any representation that any strategy will or is likely to achieve returns similar to those shown in any performance results that may be illustrated in this presentation. There is no assurance that a portfolio will achieve its investment objective.

Definitions and Indices

The S&P 500 Index is a stock market index based on the market capitalization of 500 leading companies publicly traded in the U.S. stock market, as determined by Standard & Poor’s.

Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions, or other expenses of investing. Investors cannot make direct investments into any index.

Laffer Tengler Investments, Inc. is a Registered Investment Advisor. Registration with the SEC or a state securities authority does not imply a certain level of skill or training. Laffer Tengler’s advisory fee and risks are fully detailed in Part 2 of its Form ADV, available on request.