Commentary: The Proverbial Tug of War Between Fear and Greed Continues

By Nancy Tengler, CEO & Chief Investment Officer

An undergraduate degree in psychology comes in handy when investing in the markets. Think of the stock market as an interminable struggle between fear and greed. Keeping one’s wits, understanding the effects of crowds moving into and out of ideas, the treachery of group think, and the erosive impact greed can have on total return is imperative to survival. Of all the attributes that can impact an investor’s total return, however, greed is by far the worst.

I worked with a young investor who was always swinging for the fences. He was the homerun king on his college baseball team he told me. What was your batting average, I asked? 200 was the answer. That style may have a place in baseball but not in investing. Singles and doubles are instrumental in producing above average long-term total returns. As I have said so many times: investing is about being mostly right. An occasional homerun is welcome but the constant, overriding quest for glory has no place in our business. Greed is indeed a bottomless pit of striving, without achieving the goal of sustainable total return.

How to make sense of the constant drumbeat of competing narratives. In 2014 I published The Women’s Guide to Successful Investing (stay tuned: an updated and enhanced second edition is due out in 2023) where I discussed the importance of investing in stocks to own for a lifetime. Active investing is what we do at Laffer Tengler, which is very different from active trading. In fact, the research and the actual returns of hedge funds prove active trading has a deleterious effect on total return when compared to the index. According to BarclayHedge, the average hedge fund generated net annualized returns of 7.2% over the last five years ending 2021 while the S&P 500 returned 18.5%. (Please contact Lauren Mitchell in our office: lmitchell@laffertengler.com if you would like to see our low turnover equity strategy returns.)

If you are a regular reader of our commentaries, then you know that we believe volatility is the friend of the long-term investor. The reason? Volatility and particularly sell-offs provide the opportunity to re-position your portfolio for the next three- to five-years by acquiring great companies at a discount.

Case in point: “Is Apple Sauced?” January 3, 2019 (contact Lauren Mitchell for a copy: lmitchell@laffertengler.com). The company had just warned that earnings would come in lighter than expected. Tim Cook sent a letter to investors to explain, no hiding behind a spokesperson. This was not Facebook (META) hiding from the Cambridge Analytica scandal. iPhone upgrades were slowing, China weakening and Cook wanted investors to know. We added to our holdings because we believed the fundamentals would recover—eventually great companies get their mojo back. It is important to note that since that earnings announcement on January 3, 2019, AAPL stock has returned 345% vs. 79% for the S&P 500.

Hard landing, soft landing or “no landing?” Of course, no one really knows and there are very smart people advocating for each scenario. We have been consistent in our view that the Fed’s protracted policy error allowed inflation to evolve from a slow burn into a wildfire, that inflation peaked in June of 2022 and rolled over (which is not to say the next 3% decline is going to be easy or soon), that we are likely to experience a mild recession signaled by the severely inverted yield curve and 10-months of negative readings for the Leading Economic Indicators, and that it was time to begin adding risk back into portfolios in Q4, 2022 because the market looks forward and we were closer to the end of Fed rate hikes than the beginning. Earnings have come in better than our expectations in the companies we own. This confirms what we know. Great management teams can navigate difficult economic environments and always come out stronger on the other side.

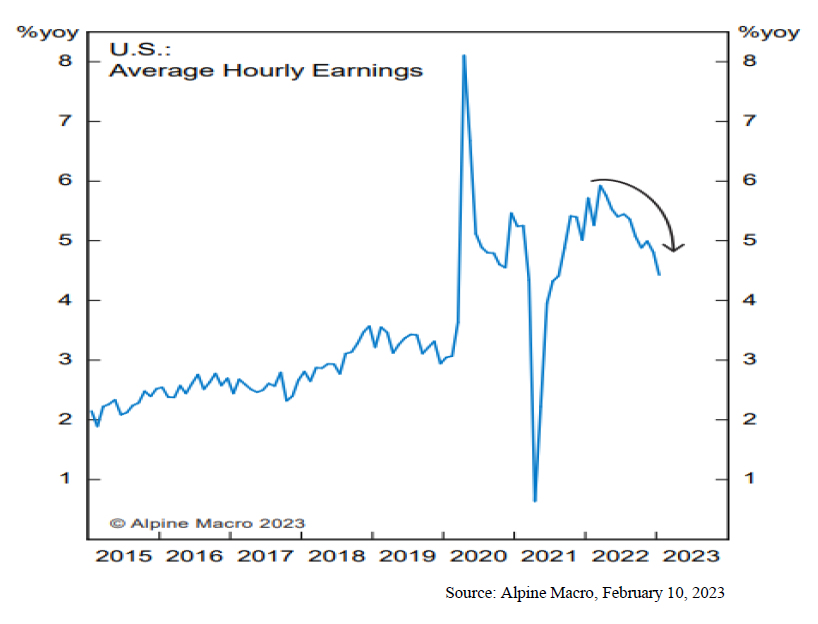

The job market may not be as strong as January’s nonfarm payrolls suggested. The report is notoriously unreliable with frequent major revisions to past data and seasonal adjustments. The methodology is imperfect (and that is being kind) yet is relied upon as gospel until the next revision. We think the wage indicators are much more important—that is what drives inflation—and we are seeing a decline in just about every metric.

In addition to Average Hourly Earnings (AHE) declining in the second half of 2022 from 6.0% to 4.4% we saw Unit Labor Costs (ULCs) come in at 1.1% in Q4 vs. 2.0% in the previous quarter. The decline in Q4 lines up nicely with the increase in non-farm productivity which rose to 3.0% from 0.8%. (ULCs measure how much a business pays its workers to produce one unit of output.) The more reliable Employment Cost Index (ECI) posted an annualized gain of about 4% in Q4 which is consistent with wage gains that align with the Fed’s 2% inflation target. In short, wages tell a different story than the unemployment rate or job growth.

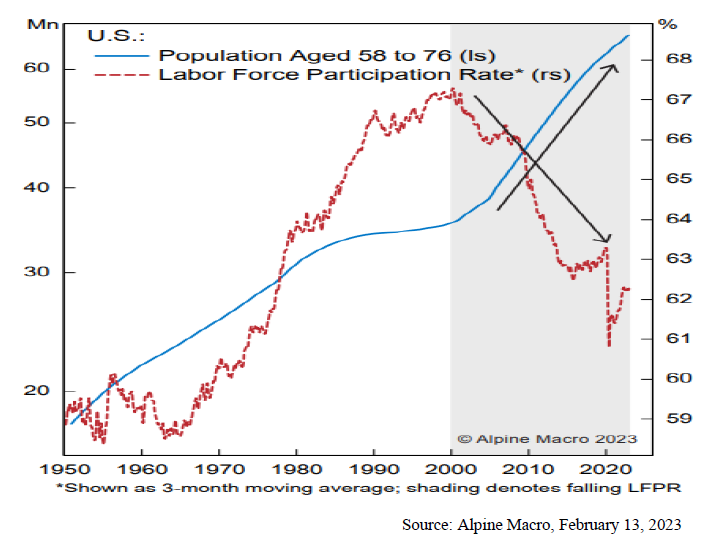

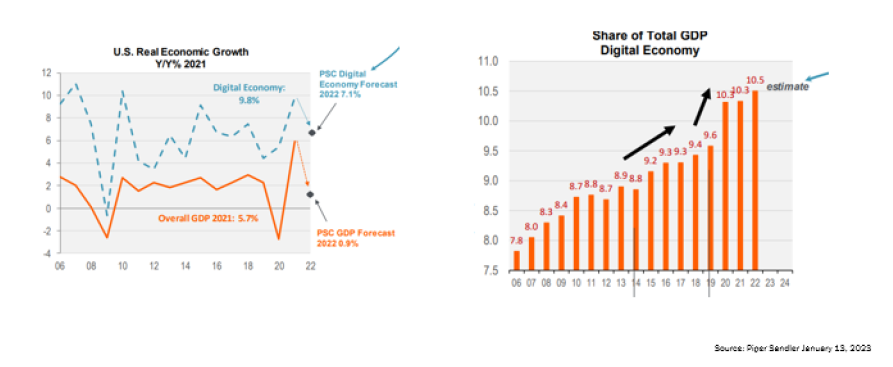

We have argued that the labor force participation rate decline is real and likely a sustainable trend as the Baby Boom cohort who retired during COVID stays retired. Because this trend is unlikely to reverse, we have further argued that investments in technology will be the answer to the labor crunch. Capex spending for technology has remained solid and digital solutions are saving the day. We will be writing a piece on the digital revolution which we believe is in the early innings of adoption.

Allow us to whet your appetite with the following charts.

The Q1 rally is one we expected though we are not arguing the bear has been fully taken down. But markets have always been and will continue to be a tug of war between fear and greed and with inflation easing and the Fed closer to the end than the beginning, we have been on the lookout for reliable growers with great management teams. We are patient and disciplined. This is not the time to swing for the fences; we will use weakness to add to names we want to own. This is exactly what we did in early January when we initiated a position in Tesla (TSLA). The stock has almost doubled in a few weeks, and we will continue to watch for additional opportunities to add to holdings. Bloomberg wrote an article about money managers for the ultra-wealthy. They dumped tech stocks during the fourth quarter when we were buying them. We have always found it helpful to stay out of the echo chamber and stick to our knitting as the old saying goes.

So, in the face of ongoing volatility we are patient, waiting for the right pitch as others swing for the fence. Because, after almost 40 years in this business we know two things for certain: volatility is the friend of the long-term investor and every bear market is eventually followed by a bull market.

General Disclosures

Advisory services offered through Laffer Tengler Investments, Inc. Information and commentary provided by Laffer Tengler Investments, Inc. (“Laffer Tengler”) are opinions and should not be construed as facts. The market commentary is for informational purposes only and should not be deemed as a solicitation to invest or increase investments in Laffer Tengler products or the products of Laffer Tengler affiliates. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. There can be no guarantee that any of the described objectives can be achieved. Laffer Tengler Investments, Inc. does not undertake to advise you of any change in its opinions or the information contained in this report. Past performance is not a guarantee of future results. Information provided from third parties was obtained from sources believed to be reliable, but no reservation or warranty is made as to its accuracy or completeness.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable. The price of any investment may rise or fall due to changes in the broad markets or changes in a company’s financial condition and may do so unpredictably. Laffer Tengler Investments, Inc. does not make any representation that any strategy will or is likely to achieve returns similar to those shown in any performance results that may be illustrated in this presentation.

There is no assurance that a portfolio will achieve its investment objective.

Laffer Tengler does not control and has not independently verified data provided by third parties, including the data presented in this report. While we believe the information presented is reliable, Laffer Tengler makes no representation or warranty concerning the accuracy or completeness of any data presented herein.

Laffer Tengler Investments, Inc. is a Registered Investment Adviser Registration with the SEC or a state securities authority does not imply a certain level of skill or training. Laffer Tengler’s advisory fee and risks are fully detailed in Part 2 of its Form ADV, available on request.