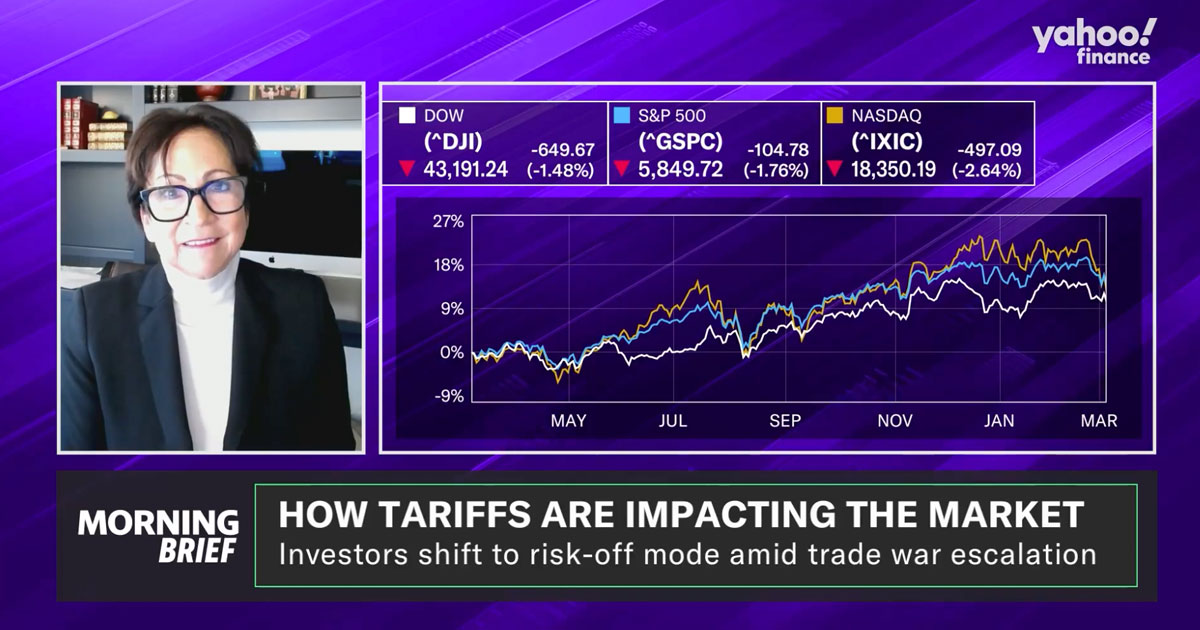

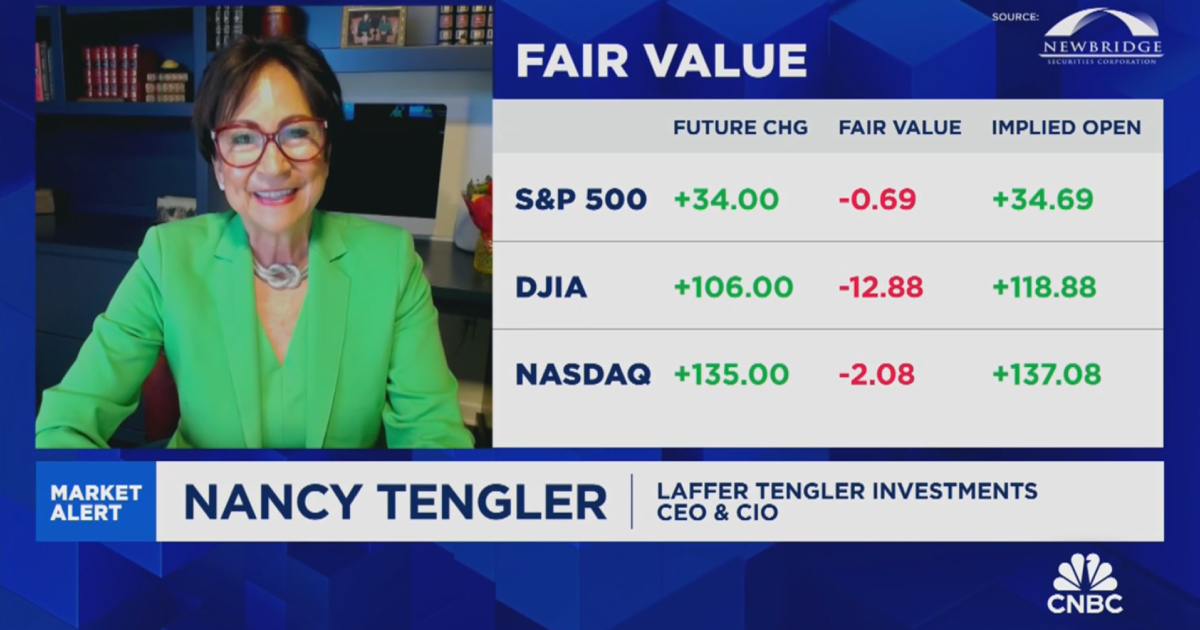

Tengler: Trump’s Tariff Narrative Creates Market Volatility

In a recent appearance on “Making Money” on Fox Business, Nancy Tengler, CEO and Chief Investment Officer of Laffer Tengler Investments, expressed concerns about the market volatility stemming from former President Trump’s tariff rhetoric. She emphasized that such narratives contribute to unnecessary instability in the stock market, affecting investor confidence and economic growth. Tengler advocated for policies that promote market stability and predictability, suggesting that a focus on consistent economic strategies would better support long-term investment and financial planning.

Read More