Tengler on Market Watch: Why the energy shock from Russia’s invasion of Ukraine won’t wreck the stock market

By William Watts and Barbara Kollmeyer, Market Watch

Oil shocks aren’t what they used to be.

In 1990, the decision by Iraqi leader Saddam Hussein to invade Kuwait sent oil prices soaring, serving to further slow a U.S. economy headed into recession. On Thursday, crude prices briefly jumped back above the $100-a-barrel threshold for the first time in more than seven years after Russia’s Vladimir Putin ordered an invasion of Ukraine.

It may be another case of history rhyming rather than repeating. The 1990 oil shock further slowed a U.S. economy that had already tipped into recession and left stocks to flounder over the next six months before regaining their footing, noted Nancy Tengler, CEO and chief investment officer at Laffler Tengler Investments.

This time around, the economy doesn’t appear in danger of recession, but growth is slowing and the Federal Reserve may have already made a policy mistake by waiting too long to raise interest rates in the face of persistent inflation, she said, in an interview.

As for oil prices, they’ve become less of a worry over time: “The good news in all of this that we use our cars less. Because first of all, we have electric vehicles, people use ride hailing, but they also are working from home to a good extent and the total impact of oil on GDP, and even individual pocketbooks, is lower than it used to be,” she said.

That means Tengler isn’t convinced by arguments that an oil or broader commodity shock is set to spark a bout of stagflation — the unpleasant combo of persistent inflation and sluggish, or stagnant, growth and high unemployment. And that brings us to the call of the day.

“We think this is a good time to be adding to holdings if you can, but not jumping in with both fists,” she said.

“We think this is a good time to be adding to holdings if you can, but not jumping in with both fists.”

Nancy Tengler, CEO & CIO of Laffer Tengler Investments

“We’re now for the first time in a period where technology capex is greater than 50%,” she said — a phenomenon that has a multiplier that will help companies deal with wage pressures.

“We’re more of the camp that growth is slowing. For the foreseeable future this year you still want to have exposure to some of these growth at a reasonable price names,” she said. “And then, when we get through the midcycle of the economy, which is where we think we are, we can think about becoming defensive.”

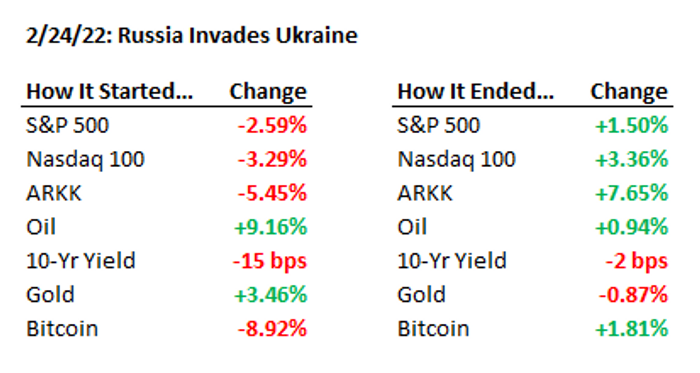

Meanwhile, war continues to rage in Ukraine, with Russian forces seen closing in on the capital Kyiv. Amid the carnage and human tragedy unleashed Thursday, financial markets witnessed some intense reversals, with U.S. equities rebounding from an initial decline to end the day higher, led by rate-sensitive tech stocks. At the closing bell, the Dow Jones Industrial Average DJIA, -1.76% was up 0.3%, while the S&P 500 SPX, -1.55% erased a 2.6% fall to end 1.5% higher and the tech-heavy Nasdaq-100 NDX, -1.63% reversed a 3.3% decline to end 3.4% higher.

The chart below from Bespoke Investment Group lays out all of big intraday turnabouts:

BESPOKE INVESTMENT GROUP

The buzz

As Russian forces closed in on Kyiv, news reports said the Kremlin on Friday agreed to talks with Ukraine, with a spokesman saying Moscow was willing to send a delegation to the Belarusian capital, Minsk.

Earnings from Foot Locker FL, -7.56% and Cinemark CNK, -2.08% rolled in ahead of Friday’s opening bell.

Among Thursday’s after-hours highlights, cryptocurrency exchange platform Coinbase Global Inc. COIN, 2.70% crushed Wall Street expectations for its fourth quarter but cast doubt on current-quarter prospects. And, dude, you’re getting a dividend: shares of computer maker Dell Technologies Inc. DELL, -2.12% were headed lower in premarket action after earnings reported Thursday night fell short of Wall Street expectations, while the company’s board initiated a dividend, starting at 33 cents a share for the quarter.

And set some reading time aside this weekend for Warren Buffett’s yearly investor letter, which is expected to accompany Berkshire Hathaway Inc’s BRK.A, -0.13% BRK.B, -1.39% annual report on Saturday.

Important inflation data came in ahead of the opening bell. The Federal Reserve’s favorite inflation calculation, the personal consumption expenditures index, rose by 0.6% in January and showed the biggest yearly increase since 1982, underscoring why the central bank is poised to raise interest rates for the first time in four years.

January durable-goods orders rose 1.6% in January, double economists’ expectations.

The markets

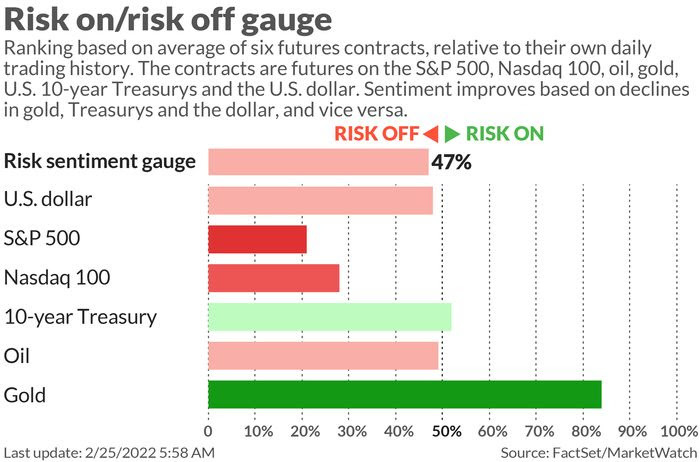

U.S. stock futures ES00, -1.51% YM00, -1.75% NQ00, -1.69% were higher after Thursday’s big bounce, with Treasury yields TMUBMUSD10Y, 1.725% on the rise, while oil prices CL00, 9.21% BRN00, 0.95% and gold GC00, 2.47% lost ground. Elsewhere, Asian markets mostly gained ground and European stocks SXXP, -2.37% bounced higher.

As published in Market Watch.