Commentary: What Could Go Right in 2023?

By Nancy Tengler, CEO & Chief Investment Officer

Sentiment will shift at some point; we want to be ahead of the pack.

Warren Buffett has said many clever things over the decades. But the following is one of my favorites: “In the business world, the rearview mirror is always clearer than the windshield.” In other words, the past is crystal clear. The future? Not so much. That is why at turning points so many investors stay too long at bull market parties and bail out when bear market routs become too much to bear (pun not intended).

I know I will offend every technical, engineering-focused mind who reads this, but in my experience, investing is about being mostly right. (Yes, I know, I know, you can’t build a bridge by being mostly right!) An important investing skill lies in sensing when to pivot. While it is nearly impossible to bottom tick the stock market—getting it mostly right can be a victory that pays off in subsequent years. If an investor buys a stock at $100 and it declines to $80 shortly thereafter but hits $300 a few years later, the best question to ask, perhaps, is why that investor didn’t buy more. Not why did he buy the stock at all.

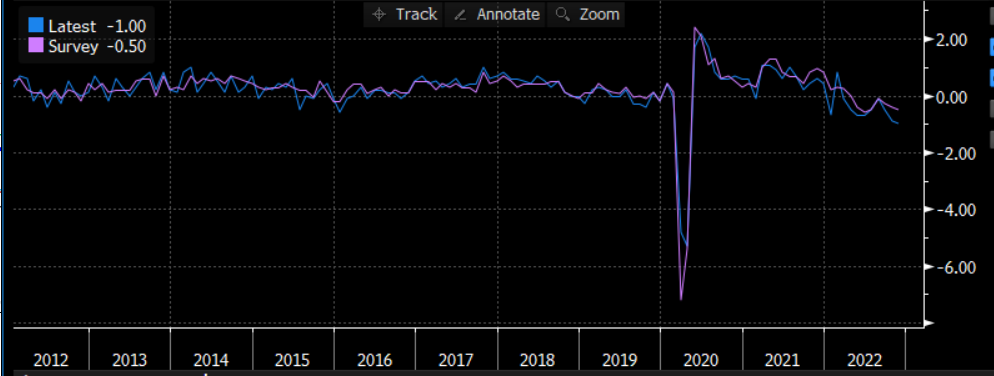

We think investors have become way too pessimistic given where we are in the rate hiking cycle. Since March the Fed has raised rates 4.25%–one of the fastest rate hiking regimes in history. And, because monetary policy has a lagged effect on the economy, we expect the economy to slow materially or enter recession at some point in 2023. To be sure a severe recession would be bearish for stocks, yet given the resilience of the U.S. economy and the tight labor market, we are expecting a slowdown or shallow and brief recession. That could allow stocks to rally in the second half of 2023 (after a volatile Q1) as they look around the recession corner.

Here is what we are watching:

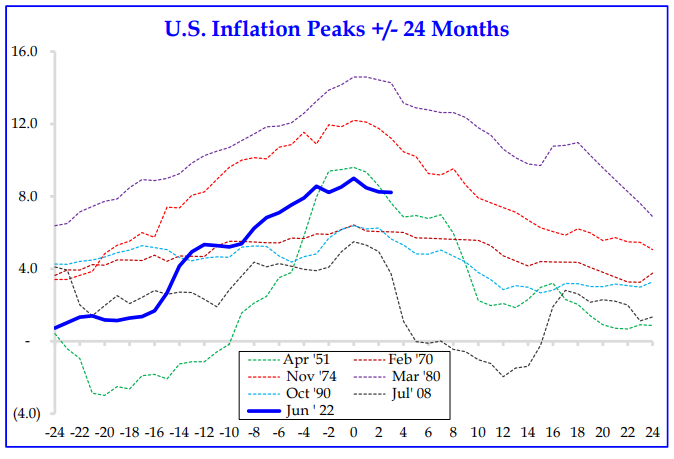

Inflation will continue to roll over. We believe inflation peaked in June. On November 2,2022, I wrote a piece “How To Make Sense Of The Columbo Economy” Link here the following:

Peak inflation and timing of Fed pause. It was our contention in the spring of 2021 that inflation would be more persistent and stickier than the Fed’s transitory view. We take no comfort in being correct. We have written that we believe peak inflation in the headline CPI was reached in June of this year when it hit 9.1%. And we believe, as history shows, that the rise and fall of inflation is mostly symmetrical. It took 16 months to peak and now we expect it will take a like amount of time to get to a tolerable level (not necessarily 2.0%–the Fed’s target).

We would emphasize that the trend is not necessarily linear as you can see in the chart above. But, inflation is, indeed, rolling over.

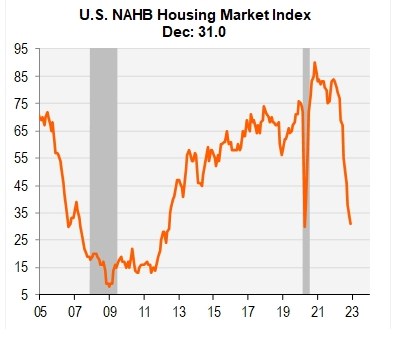

Housing is in freefall, manufacturing PMIs are in contraction, inventories are up, prices paid down, energy costs have come in, used car prices have declined materially as have airfares and hotels, wheat and corn are down, shipping costs have plummeted, copper, aluminum and palladium are well off their highs, and medical insurance costs are set to decline by –40% over the next 12 months. While we don’t think the Fed’s 2% inflation target is on the horizon, we do think inflation will surprise many to the downside.

Recession likely but not deep. The inversion of the yield curve and the steady decline in Leading Economic Indicators (chart below) almost ensure we see an official recession (versus 2022’s slowdown) at some point in 2023. The question? How severe and long will the slowdown in economic growth end up being?

The consumer still has bandwidth and given the tight labor market we think spending will hold up better than the naysayers predict. Which is not to say it won’t slow. But generally, we think the bears (never eager to leave the stage) are too pessimistic.

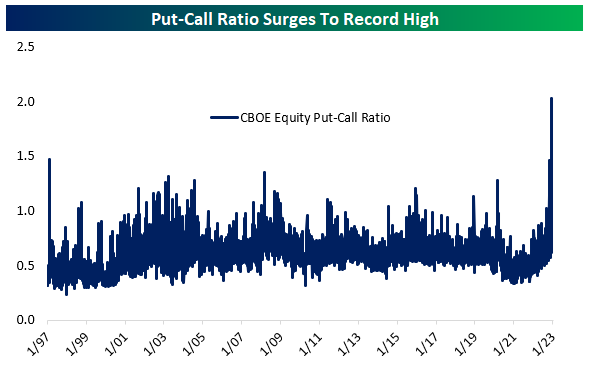

Sentiment is too negative (this is not the 1980s). Recent put volumes outnumbered call volumes by a factor of 2 on the CBOE—the highest level since the data has been measured. The move was driven by a surge in put options and a decline in call options. The put call ratio tends to be a contrary indicator spiking when investors are too pessimistic. Add to that institutional investors have remained on the sidelines with allocations to equities below levels held in 2008!

What are we worried about?

- The omnibus bill is likely to put upward pressure on inflation just as the Fed is making progress. Another day another $1.8 trillion in spending.

- The transition to onshoring/re-shoring could be a little messy but good news in the long-term. Hundreds of companies have announced their intention to move manufacturing back to the United States. Many are shifting from China to India and Vietnam.

Geopolitical tension in the South China Sea.

The Bear Market of 2023, if over, would rank as one of the mildest of the 14-prior post—World War II bear markets at 282 days. Interestingly according to our friends at Bespoke Investment Group, this bear market has experienced seven 5% rallies, three of which extended to 10%. Those facts belie the way many feel about this bear market. I have been at this a long time and the only bear market that felt worse was the one that spanned 2001-2003. Investors are exhausted. Ultimately that will bode well for stocks in 2023. Q1 could be choppy (perhaps we will see the price exhaustion indicators marking a bottom then?) but we think the returns on stocks will be positive in 2023, though not necessarily spectacular.

Beware of unintended consequences. When government inserts itself into the free market unintended consequences abound. In 2022, due to high natural gas prices (wind and solar were unable to offset lower energy production from hydro and nuclear power) global coal usage hit an all-time high according to a report by the IEA.

Here’s to a Happy and Prosperous New Year!

General Disclosures

Advisory services offered through Laffer Tengler Investments, Inc. Information and commentary provided by Laffer Tengler Investments, Inc. (“Laffer Tengler”) are opinions and should not be construed as facts. The opinions expressed are those of Laffer Tengler’s Investment Team. The opinions referenced are as of the date of the publication and are subject to change due to changes in the market or economic conditions that may not necessarily come to pass. Forward-looking statements cannot be guaranteed. This is not a recommendation to buy or sell a particular security, nor is it financial advice or an offer to sell any product.

The market commentary is for informational purposes only and should not be deemed as a solicitation to invest or increase investments in Laffer Tengler products or the products of Laffer Tengler affiliates. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. There can be no guarantee that any of the described objectives can be achieved. Laffer Tengler Investments, Inc. does not undertake to advise you of any change in its opinions or the information contained in this report. Past performance is not a guarantee of future results. Information provided from third parties was obtained from sources believed to be reliable, but no reservation or warranty is made as to its accuracy or completeness.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable. The price of any investment may rise or fall due to changes in the broad markets or changes in a company’s financial condition and may do so unpredictably. Laffer Tengler Investments, Inc. does not make any representation that any strategy will or is likely to achieve returns similar to those shown in any performance results that may be illustrated in this presentation. Always consult a financial, tax, and/or legal professional regarding your specific situation.

There is no assurance that a portfolio will achieve its investment objective. Past performance is not indicative of future results.

Definitions and Indices

The S&P 500 Index is a stock market index based on the market capitalization of 500 leading companies publicly traded in the U.S. stock market, as determined by Standard & Poor’s.

Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions, or other expenses of investing. Investors cannot make direct investments into any index.

Laffer Tengler Investments, Inc. is a Registered Investment Advisor. Registration with the SEC or a state securities authority does not imply a certain level of skill or training. Laffer Tengler’s advisory fee and risks are fully detailed in Part 2 of its Form ADV, available on request.

6710 North Scottsdale Road

Suite 210

Scottsdale, Arizona 85253